If you’re already in (or evaluating) the XPEL ecosystem, the most useful way to understand “current strategy” is to look at how XPEL consistently builds growth across dealers and retail – and what support actually reaches partners.

XPEL’s own investor materials describe a diversified channel strategy (aftermarket shops, dealerships/body shops, OEM, e-commerce), and they explicitly call out demand drivers like lead generation, event marketing, influencer partnerships, media relations, and brand/product campaigns.

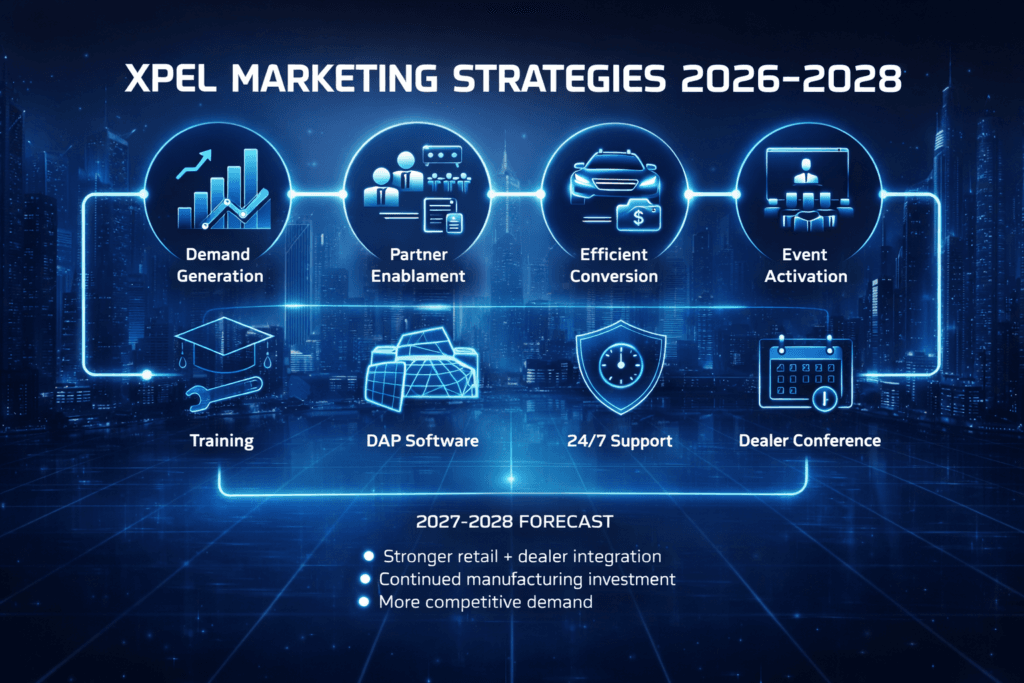

The 2026 playbook in plain terms

XPEL’s marketing strategy is less about a single “campaign of the month” and more about a repeatable system:

- Build demand (brand + performance marketing + events)

- Enable partners (tools, training, software, support)

- Convert at the point of sale (especially in dealership flows)

- Scale through channel structure (aftermarket and dealership programs)

What XPEL provides to dealers and partners (what exists, not fluff)

Dealer network access: products, training, tools, support

On XPEL’s dealer pages, the promise is straightforward: access to products, expert training, tools, and support aimed at business growth.

Training: not only “how to install”, but how to standardize outcomes

XPEL’s investor deck states they offer beginner and advanced training for core offerings (PPF, coatings, window tint, architectural film), available onsite/offsite across corporate training facilities in multiple countries.

Software and workflows: DAP and DAPNext

The same investor materials describe:

- DAP access to 80,000+ patterned paint protection kits for certified installers

- DAPNext positioned as an “all-in-one digital business solution” directionally (a workflow layer, not just cutting files)

This matters for dealers because it reduces delivery risk: consistency, speed, and fewer “pattern problems” at scale.

Customer support: always-on operational assistance

XPEL’s investor deck also states a designated support team is available 24/7, including help expediting orders, troubleshooting software, and advising on business solutions.

Dealership models: three ways XPEL can fit a dealer’s capacity

XPEL’s investor presentation lays out flexible dealership delivery models:

- Internal program (dealer installs in-house, supported by tools/training/software)

- XPEL partnership (XPEL provides end-to-end installation services, including embedded teams for high-volume programs)

- Aftermarket partnership (dealer outsources to a certified local installer and retains margin through retail markup)

They also describe dealership add-on dynamics: products integrated at point of sale, bundling across PPF/tint/coatings, and a “feeder” approach into upsells in the F&I department, combined with compliant addendum software.

Where “current campaigns” usually show up for dealers and retail

Instead of guessing specific promotional offers, it’s more actionable to map the campaign buckets XPEL explicitly invests in:

- Lead generation (demand capture)

- Global and local event marketing (partner activation)

- Influencer partnerships and media relations (reach + credibility)

- Brand and product campaigns (message consistency)

That’s the backbone. Individual campaigns rotate; the machine stays.

Partner activation: the Dealer Conference and events

For North America partners, XPEL publishes a dedicated Dealer Conference and event presence. The Dealer Conference page lists XPEL Dealer Conference 2026 on January 23-24, 2026.

XPEL’s events page also positions the dealer conference as including product training plus marketing and business education (with venue details listed there).

For dealers, the practical takeaway is simple: XPEL uses events as a strategy lever, not a side activity.

Table: Support → dealer benefit → what to do next

| What XPEL provides (documented) | What it does for a dealer | How to turn it into revenue |

|---|---|---|

| Dealer network value: products, training, tools, support | Reduces sourcing + training friction; strengthens credibility | Build a “protection menu” (PPF/tint/coatings) and set attach-rate targets |

| Training across core product offerings | Standardizes quality and reduces rework | Create a certification ladder for staff or partner installers |

| DAP with 80,000+ patterns; DAPNext direction | Faster fulfillment, fewer fit issues, better scalability | Offer “same-week install” promises for common models; reduce waste and labor variance |

| 24/7 customer support for orders/software/business help | Keeps ops moving; fewer stalled deals | Establish an escalation path internally so issues don’t sit overnight/weekend |

| Dealership delivery models (internal/XPEL partnership/aftermarket) | Flexibility by capacity and control | Choose a model per rooftop: high-volume uses embedded/outsourced; low-volume uses local certified partner |

| Event marketing and dealer conference | Training + playbooks + partner momentum | Treat events as your “annual reset”: new scripts, new bundles, new targets |

2026-2028 outlook: what’s likely to change, and why it helps dealers

What’s already visible heading into 2026

XPEL has publicly discussed strategic investments in manufacturing and supply chain (announced alongside Q3 2025 results).

In the Q3 2025 earnings call transcript, management also discusses investing more in manufacturing and supply chain through approaches like CapEx, M&A, or JV relationships.

For dealers, supply chain improvement generally means fewer fulfillment surprises and a more dependable service promise.

A reasonable 2027-2028 forecast (labelled forecast)

This is a forecast, not a guarantee – but it follows the incentives in the public materials above and the overall market direction.

- Forecast: More emphasis on scalability and operational efficiency

If manufacturing/supply investments execute well, partners should see stronger consistency, availability, and potentially better unit economics over time. - Forecast: Dealer + retail integration becomes more structured

XPEL’s channel framing puts meaningful weight on dealerships/body shops, and explains how add-ons feed upsell paths. Expect ongoing refinement of dealership workflows, packaging, and program execution. - Forecast: Demand remains competitive, so conversion quality matters more

Market outlook sources project continued PPF growth through the late-2020s, which typically attracts more installers and more bidding for the same attention – pushing dealers to improve bundling, scripting, and delivery speed.

How dealers should act (practical, not motivational)

Next 30 days: get your offer and workflow tight

- Decide your delivery model per location: internal vs outsourced vs embedded support

- Create 3 packages: entry, mid, premium (PPF + tint/coatings bundles fit the channel logic described in investor materials)

Next 60 days: turn support into measurable KPIs

- Set attach-rate targets (dealer-sold), plus lead-to-install targets (retail)

- Build a service SLA: install scheduling, QA checklist, redo policy

- Document your escalation path using support and software resources

Next 90 days: align with event cycles and content cycles

- Use the Dealer Conference/event calendar as a planning anchor (new scripts, new bundles, new quarterly targets)

- Turn “brand campaigns” into local execution: before/after library, proof assets, financing-ready package sheets

FAQ

What does XPEL dealer program marketing support typically include?

At the program level, XPEL emphasizes access to products, training, tools, and support. Investor materials also detail training programs, DAP software access, and 24/7 support coverage.

How does XPEL support dealership-scale installs if our team can’t handle volume?

XPEL’s investor deck describes multiple dealership models, including an approach where XPEL provides end-to-end installation services with embedded teams for high-volume programs, and an aftermarket partnership route using certified local installers.

Is the dealer conference worth prioritizing?

XPEL positions the dealer conference as a premier event and pairs it with marketing and business education alongside product training, which is exactly where program execution improves fastest.

What’s the biggest dealer-side advantage in 2026-2028?

If the manufacturing and supply chain investments deliver as described publicly, dealers benefit most through reliability: steadier fulfillment, more predictable operations, and a stronger ability to promise turnaround times.

CTA

If you’re an existing dealer/partner, the fastest win is to treat XPEL’s ecosystem as a system: pick the right dealership model, tighten the offer ladder, and build KPIs around attach rate and fulfillment speed. Then use the annual event cycle to refresh scripts, packages, and training.

If you’re a potential partner, start by mapping your current capacity (install volume, staffing, scheduling discipline) to the three dealership models, and list what support you’d need to scale without quality drift.

References

[1] Become An XPEL Dealer – Grow your Business (https://www.xpel.com/for-business/dealers)

[2] Become an XPEL Dealer | Grow Your Business with XPEL (https://www.xpel.com/become-a-dealer)

[3] XPEL Dealer Conference (https://www.xpel.com/dealer-conference)

[4] XPEL Events – Upcoming Shows and Exhibitions (https://www.xpel.com/events)

[5] XPEL Investor Deck October 2025 (https://s204.q4cdn.com/619560229/files/doc_presentations/2025/Oct/XPEL-Investor-Deck-October-2025.pdf)

[6] XPEL Reports Revenue Growth of 11.1% to $125.4 million in Q3 2025 (Business Wire) (https://www.businesswire.com/news/home/20251105973765/en/XPEL-Reports-Revenue-Growth-of-11.1-to-%24125.4-million-in-Third-Quarter-2025-Announces-Strategic-Investments-in-Manufacturing-and-Supply-Chain)

[7] XPEL Q3 2025 Earnings Call Transcript (The Motley Fool) (https://www.fool.com/earnings/call-transcripts/2025/11/06/xpel-xpel-q3-2025-earnings-call-transcript/)

[8] North America Paint Protection Film Market Size & Outlook (Grand View Research) (https://www.grandviewresearch.com/horizon/outlook/paint-protection-film-market/north-america)

[9] Paint Protection Film Market Size 2025-2029 (Technavio) (https://www.technavio.com/report/paint-protection-film-market-industry-analysis)